Revolutionary digital tax reporting platform

TaxIntell

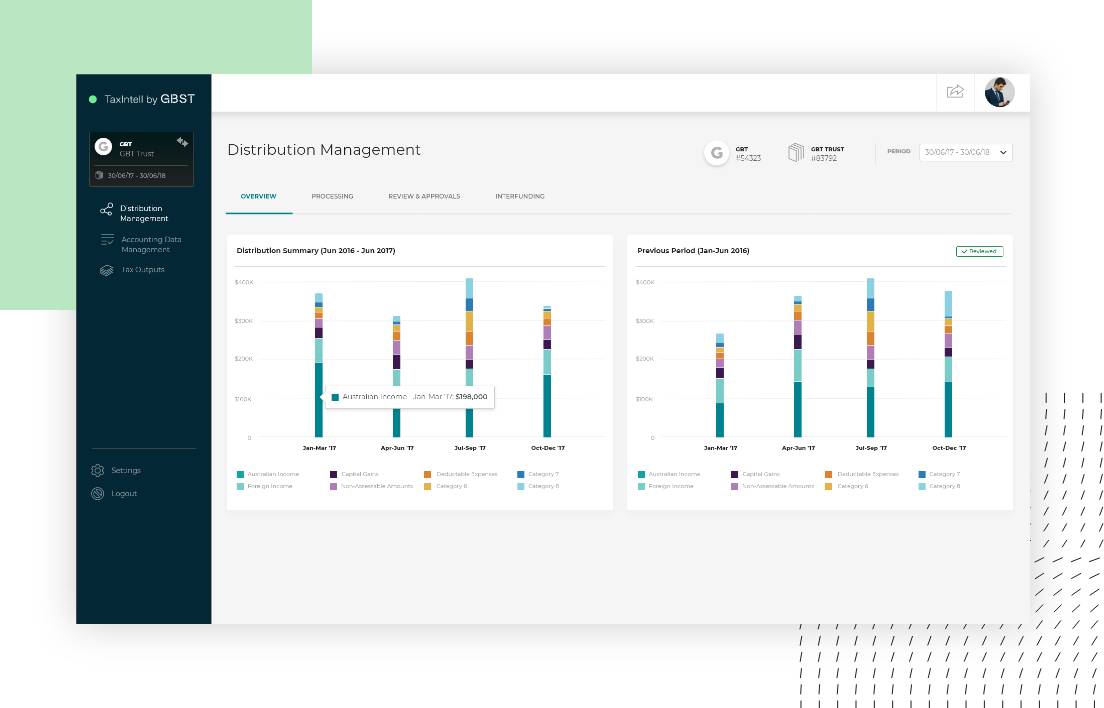

Streamlined tax reporting with real-time collaboration between superannuation funds, investment trusts, custodians and tax advisers

Single source of truth

TaxIntell brings together disparate data sources to streamline the preparation, analysis, review and submission of Superannuation Fund and Investment Trust tax reporting needs. The ability to drill down to source data provides a new level of transparency and auditability, enabling active monitoring and reporting of tax throughout the year.

Collaborate with confidence

TaxIntell reduces the latency of the tax review process by providing a secure digital platform for collaboration with stakeholders, replacing processes that are typically performed manually, communicated via email and run on spreadsheets.

Reducing time spent on cleaning, reviewing and sending data frees up resource to focus on valuable tax strategy.

Year-round tax management

The platform regularly pulls data from various sources including your own records, your custodian records and your registry provider, then automatically validates, calculates and presents the results.

This provides a real-time view of tax data, so you can monitor and validate records on the go, addressing issues as they happen rather than at the year-end crunch time.

Centralised and secure

- Track every user and activity with all roles and privileges separately audited, amendments tracked and approval workflows

- Set tax rules to align with your preferred tax treatment rather than making manual changes outside the system

- Verify the quality of underlying data with three levels of validation before running calculations and producing accounting to tax reconciliations

“The selection of the TaxIntell software was another example of Asset Servicing putting the customer experience first, incorporating industry leading technology to address the changing needs of their clients.”

John Comito

Executive General Manager, NAB Asset Servicing

When you’re ready to submit your tax reporting, it just takes a few clicks. Our Standard Business Reporting 2 (SBR2) framework connects TaxIntell to the Australian Tax Office platform for secure and efficient submission.